You are here:iutback shop > airdrop

**Busd vs Usdt Binance Fee: A Comprehensive Analysis

iutback shop2024-09-21 15:23:20【airdrop】3people have watched

Introductioncrypto,coin,price,block,usd,today trading view,**In the ever-evolving world of cryptocurrency, the choice of stablecoins has become a crucial facto airdrop,dex,cex,markets,trade value chart,buy,**In the ever-evolving world of cryptocurrency, the choice of stablecoins has become a crucial facto

In the ever-evolving world of cryptocurrency, the choice of stablecoins has become a crucial factor for traders and investors. Among the most popular stablecoins are BUSD and USDT. Both are widely used on the Binance platform, and understanding their respective fees can significantly impact trading decisions. This article delves into a comprehensive analysis of the BUSD vs USDT Binance fee structure, highlighting the key differences and considerations for users.

**Understanding BUSD and USDT

**BUSD (Binance USD) is a stablecoin issued by Binance, one of the largest cryptocurrency exchanges in the world. It is designed to maintain a 1:1 peg with the US dollar, ensuring stability and reliability. On the other hand, USDT (Tether) is a stablecoin that aims to do the same, with a strong track record of maintaining its value against the US dollar.

**Binance Fee Structure

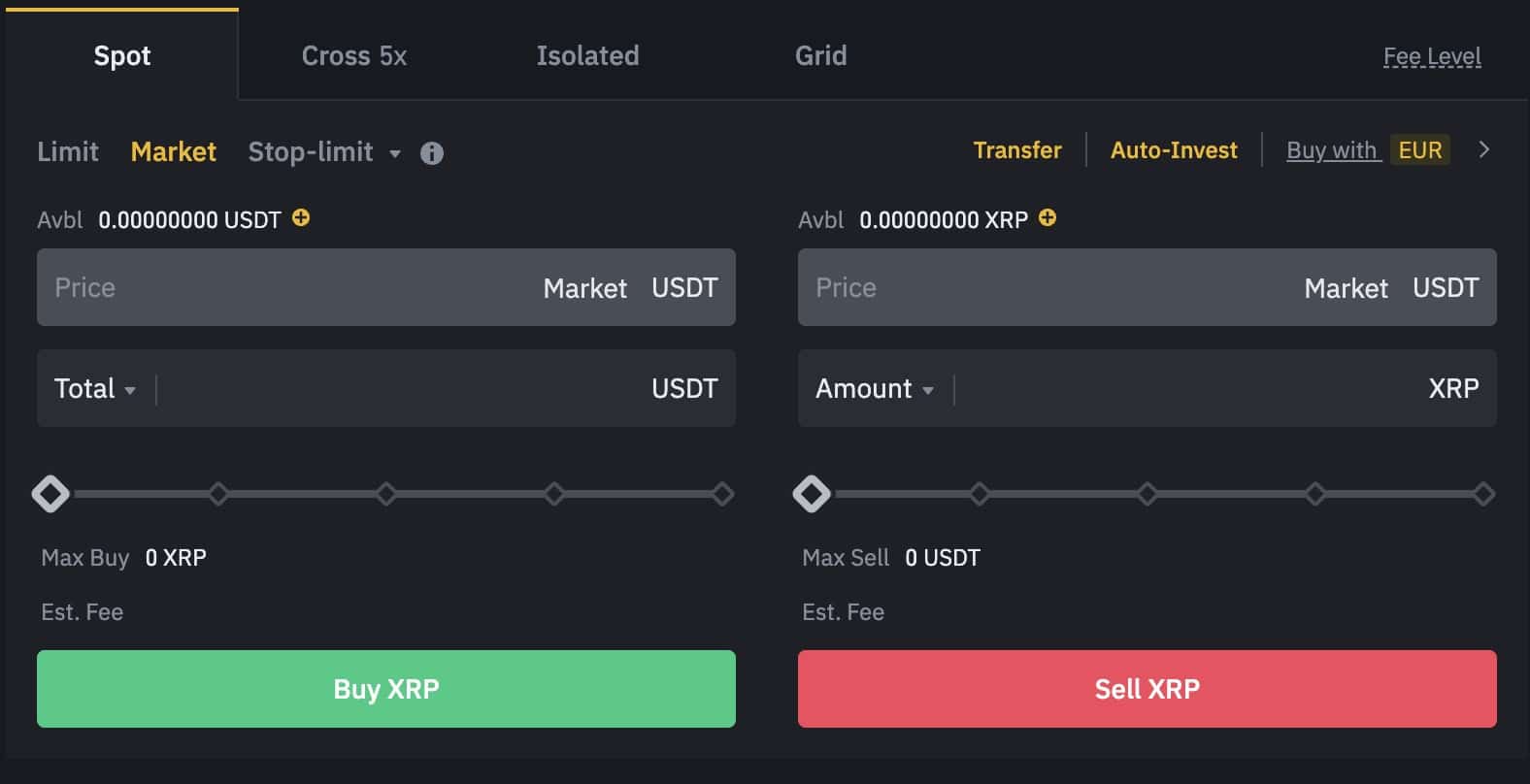

**Binance, being a leading cryptocurrency exchange, offers a variety of trading pairs, including those involving BUSD and USDT. The fees associated with trading these pairs can vary, and it's essential to understand how they impact your trading activities.

**BUSD vs USDT Binance Fee: Trading Fees

**When it comes to trading fees on Binance, both BUSD and USDT are subject to the same fee structure. Binance charges a flat fee for each trade, which is calculated based on the trading volume and the user's trading tier. The fee for each trade is typically around 0.1% for makers and 0.2% for takers. However, this can vary depending on the user's trading tier and the specific trading pair.

For example, if a user is trading BUSD/USDT on Binance, the fee structure would be the same as trading any other pair involving these stablecoins. This means that the BUSD vs USDT Binance fee for trading is consistent across both stablecoins.

**BUSD vs USDT Binance Fee: Withdrawal Fees

**Another crucial aspect to consider is the withdrawal fee for both BUSD and USDT. Binance charges a withdrawal fee for each transaction, which is designed to cover the costs associated with processing and securing the withdrawal. The withdrawal fee for both stablecoins is generally the same, although it can vary slightly based on the network congestion and the specific blockchain used.

For instance, the withdrawal fee for BUSD and USDT on Binance is typically around $1.50, but this can increase during times of high network congestion.

**BUSD vs USDT Binance Fee: Conclusion

**In conclusion, the BUSD vs USDT Binance fee structure is quite similar, with both stablecoins subject to the same trading and withdrawal fees. While the fees are consistent across both stablecoins, it's essential to consider other factors such as transaction speed and network reliability when choosing between BUSD and USDT.

Traders and investors should weigh the pros and cons of each stablecoin based on their specific needs and preferences. Whether you're looking for a stablecoin for trading or as a store of value, understanding the fee structure is crucial for making informed decisions.

In the dynamic world of cryptocurrency, staying informed about the BUSD vs USDT Binance fee is key to maximizing your trading potential. By understanding the nuances of the fee structure, users can make more strategic decisions and potentially enhance their trading outcomes.

This article address:https://www.iutback.com/blog/09b33499656.html

Like!(3)

Related Posts

- Bitcoin Price First Time: A Milestone in Cryptocurrency History

- Robot Trading in Binance: Revolutionizing Cryptocurrency Trading

- How to Find Your Binance Smart Chain Address: A Comprehensive Guide

- Zombie Bitcoin Wallets: A Growing Concern in the Cryptocurrency World

- Enable Bitcoin Cash App: A Game-Changer for Cryptocurrency Users

- How Easy to Cash Out Bitcoin: A Comprehensive Guide

- How to Get Binance App on iPhone: A Step-by-Step Guide

- Can I Buy Bitcoin and Hold It?

- The Rise of HD Wallet Bitcoin: A Secure and Convenient Solution for Cryptocurrency Storage

- Bitcoin Yearly Prices: A Comprehensive Analysis

Popular

Recent

Bitcoin Cloud Mining Investment: A Lucrative Opportunity in the Cryptocurrency World

How Does Mining Bitcoin Work?

Bitcoin Mining 101: A Beginner's Guide to the World of Cryptocurrency Mining

Confirm This Transaction in Your Wallet: PancakeSwap Binance Wallet

The Price of Bitcoin on Binance: A Comprehensive Analysis

If Stock Prices Go Down, What Happens in Bitcoin?

What Was the Price of Bitcoin in December 2019?

The Price of Bitcoin When It Started: A Journey Through the Cryptocurrency's Early Days

links

- ### P2P USDT Binance: A Comprehensive Guide to Peer-to-Peer Trading on the World's Leading Exchange

- Is Bitcoin Cash Different Than Bitcoin?

- Binance Smart Chain: The Future of BEP20 Tokens

- **Unlocking Efficiency: Mastering the Mining Bitcoin CZ Pool Port

- **Optimizing Test Hardware for Bitcoin Mining: A Comprehensive Guide

- Is There a Bitcoin Scam on Cash App?

- What Did ASIC Mining Do to Bitcoin?

- The Safest Way to Generate a Bitcoin Wallet

- What Coins Does Binance Support: A Comprehensive Guide

- Can I Stake on Binance.US? A Comprehensive Guide